Impact of Unexpected Expenses on Your Credit: What to Do?

Understanding the Financial Landscape

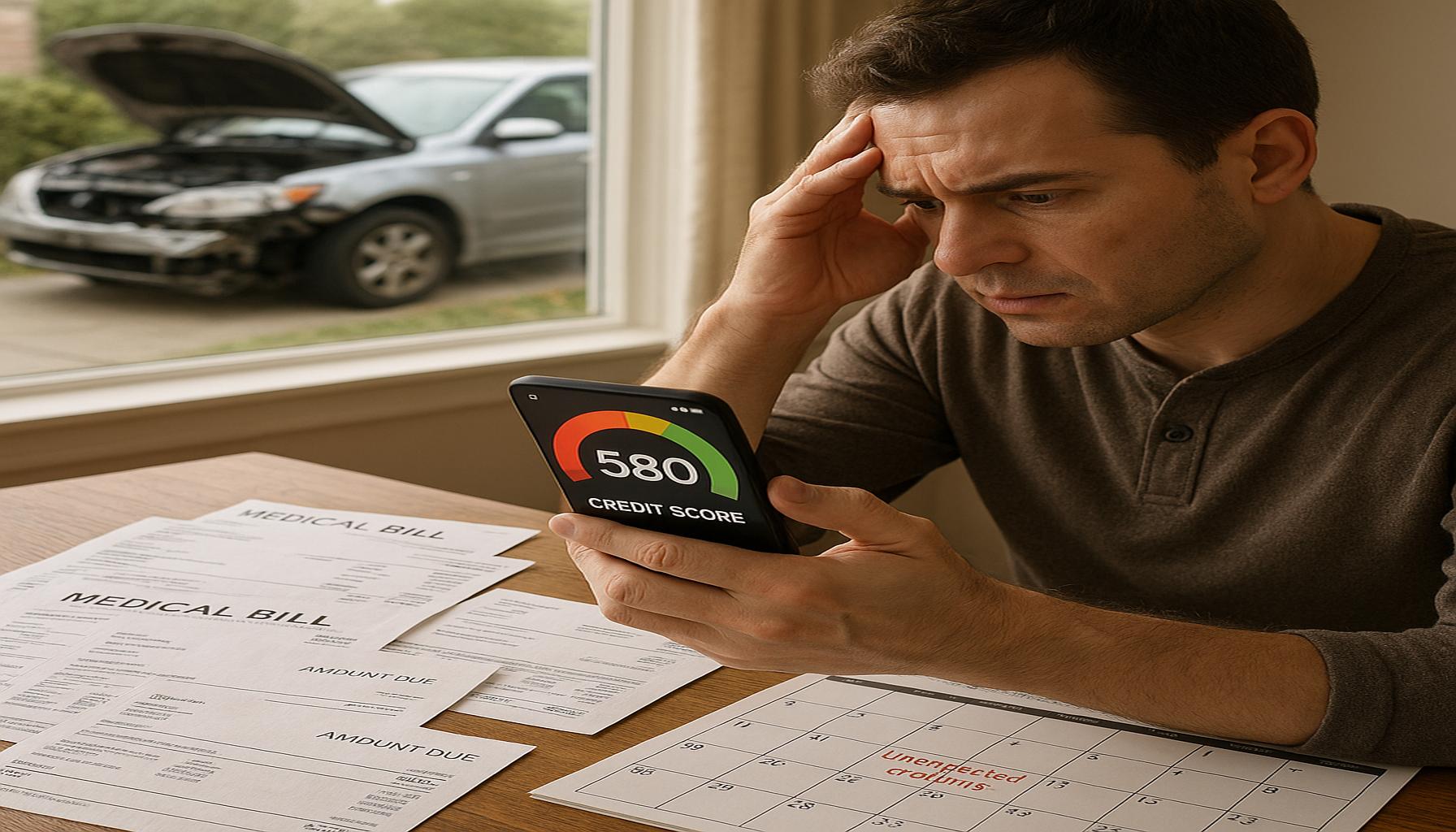

In today’s fast-paced digital economy, financial management has taken on new dimensions, presenting both opportunities and challenges for individuals. As expenses can sometimes emerge unannounced, understanding their effects on your financial status becomes increasingly vital. For instance, unexpected expenses, such as a sudden medical emergency requiring immediate attention, can significantly disturb your budget and potentially necessitate using credit cards, which might impact your credit score.

Common Unexpected Expenses

Some typical examples of unforeseen expenses that people in the United States may encounter include:

- Medical emergencies: A trip to the emergency room or procedures that insurance may not fully cover can leave significant financial marks.

- Car repairs: Events like engine failures or fender benders often require prompt financial responses, leading many to rely on credit.

- Home maintenance issues: Problems such as plumbing leaks or roof repairs can be not only frustrating but also costly, adding to the financial burden.

- Job loss or reduced income: Economic fluctuations and market changes can abruptly affect employment stability, making budgeting even more critical.

Dealing with these circumstances often leads to increased reliance on credit. While this can provide short-term relief, it can result in long-term repercussions for your financial health. Understanding how to balance immediate needs with long-term credit implications is crucial in maintaining financial well-being.

Embracing Technological Innovations

In this era of financial digitization, innovative solutions pave the way for more effective budgeting and expense tracking. Technologies like AI-driven budgeting apps encourage users to anticipate potential financial pitfalls. These advanced applications analyze spending habits, alert users to irregular expenses, and recommend strategies for managing tight budgets while minimizing the impact on credit.

Moreover, digital payment platforms and online savings accounts allow individuals to transfer money, make payments, and save with incredible ease. Many of these platforms offer features like automatic savings, helping users to set aside funds for emergencies, which could prevent the necessity of relying on credit in the first place.

Financial Resilience in A Changing Landscape

As we strive to maintain financial equilibrium in an ever-evolving economic arena, acquiring the skills to navigate unexpected expenses and their ripple effects is indispensable. The fusion of innovative tools and a mindset geared towards financial adaptability equips you with the knowledge and resources necessary for enduring fiscal health. By adopting these futuristic tools and strategies, you can preserve your credit standing, ensuring that you remain financially resilient, regardless of the uncertainties the future holds.

DISCOVER MORE: Click here to learn how to apply easily

Navigating the Financial Storm

Unexpected expenses can feel like a storm that disrupts your financial forecast. When faced with sudden costs, the immediate reaction often involves seeking quick solutions, which can lead to an unintended reliance on credit. This response, while sometimes necessary, can have profound implications for your credit score and overall financial health.

The Ripple Effects on Your Credit

When faced with urgent financial needs, many individuals resort to credit cards or loans, which can introduce a variety of challenges:

- Increased credit utilization: One of the leading factors affecting your credit score is your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. If you max out or significantly increase your credit card balances, your utilization ratio can spike, potentially lowering your score.

- Late payment risk: If existing expenses leave little room in your budget for debt repayment, you may find yourself missing payments. Late payments can severely damage your credit rating, reflecting negatively on your credit history for years.

- Debt accumulation: Relying on credit for repeated unexpected expenses can lead to a debt cycle that becomes increasingly difficult to escape. Higher overall debt levels not only impact your credit score but can also result in higher interest rates on future borrowing.

Understanding these potential consequences is crucial, as the impact on your credit can extend beyond your current financial situation. A low credit score can affect your ability to qualify for loans, secure favorable interest rates, and even influence your rent applications. In short, unexpected expenses can send shockwaves through your financial landscape, emphasizing the need for effective management strategies.

Proactive Strategies for Financial Management

In light of these challenges, embracing a proactive approach to financial management becomes vital. Leveraging emerging technologies can empower individuals to tackle unexpected expenses head-on while safeguarding their credit health:

- Emergency funds: Establishing an emergency fund can be a financial lifesaver. Aim to save at least three to six months’ worth of living expenses, which can alleviate the need to rely on credit in times of crisis.

- Budgeting tools: Utilize innovative budgeting apps that can help track your spending and identify areas where you can cut back. Many of these tools integrate with your bank accounts, providing real-time insights into your financial situation.

- Credit monitoring services: Consider signing up for a credit monitoring service that alerts you to changes in your credit score. Staying informed about your credit status allows you to take timely actions to mitigate any negative impacts.

By implementing these strategies, you can not only prepare for the financial surprises that life may throw your way but also strengthen your financial foundation, ensuring that your credit remains intact even amidst uncertainty.

DIVE DEEPER: Click here to discover how to improve your credit score

Embracing Digital Solutions for Financial Resilience

As we navigate the evolving landscape of finance, the integration of technology into our financial decision-making process has become increasingly pivotal. The advent of fintech solutions has opened up new avenues to manage unexpected expenses more effectively while preserving your credit standing. By leveraging these innovative tools, individuals can streamline their financial strategies and embrace a more resilient approach to dealing with unforeseen costs.

Harnessing the Power of Personal Finance Apps

Today, personal finance applications are revolutionizing the way we manage money. These apps go beyond basic budgeting—they offer real-time analytics that can help you anticipate and prepare for unexpected expenses. For example, platforms like Mint or YNAB (You Need A Budget) not only help you track spending but also provide forecasts based on your historical spending patterns. This foresight enables you to adjust your budget proactively, ensuring that you are better prepared for financial surprises.

Exploring Peer-to-Peer Lending

In situations where credit cards may not be the best option due to high-interest rates or the risk of maxing out available credit, peer-to-peer lending has emerged as a compelling alternative. Services like LendingClub or Prosper connect borrowers directly with investors looking to lend money. These platforms typically offer lower interest rates compared to traditional loans and provide a quicker, more flexible solution to unexpected expenses. This option can help you avoid high utilization ratios and protect your credit score.

Leveraging Artificial Intelligence for Financial Insights

Artificial intelligence is making waves in the financial sector, providing personalized recommendations and insights that traditional banking methods often lack. AI-based tools can analyze your spending habits and alert you to potential cash shortfalls before they occur. For instance, platforms like Clarity Money use AI algorithms to suggest ways to save on recurring bills or provide insights into unused subscriptions that can be cut. By managing your expenses more efficiently, you can minimize the risk of falling into debt during emergencies.

Digital Banking and Instant Access to Funds

The rise of digital banking has dramatically changed how individuals access funds, especially in urgent situations. Banks like Chime and Ally offer no-fee overdraft protection and faster access to direct deposit funds. These digital banks facilitate quick financial solutions, empowering you to meet unexpected costs without accumulating high-interest debt. Additionally, many of these platforms provide tools for tracking your spending in real-time, helping you make informed decisions that ultimately protect your credit health.

Community and Crowdfunding Platforms

Beyond traditional lending, community-driven platforms such as GoFundMe or Kickstarter have created opportunities for people facing unexpected financial burdens to seek help from friends, family, and even strangers. While this may not be a conventional approach to dealing with unexpected expenses, it showcases the innovative spirit of community support. These platforms allow individuals to raise funds for urgent medical bills, car repairs, or other emergencies, providing a pathway to financial relief without harming one’s credit score.

In a world where unexpected expenses can feel overwhelming, adopting technology and innovative financial solutions can empower individuals to stay buoyant amidst financial uncertainty. By embracing these advancements, you can protect your credit while navigating life’s unpredictability.

DIVE DEEPER: Click here to discover effective strategies

Conclusion: Navigating Financial Surprises with Confidence

In today’s fast-paced world, unexpected expenses can disrupt even the best-laid financial plans, posing a significant risk to your credit health. However, by leveraging the power of digital solutions and innovative financial tools, you can cultivate resilience in the face of unforeseen costs. The integration of personal finance apps, peer-to-peer lending, and AI-driven insights empowers individuals to manage their finances more effectively, turning potential crises into manageable situations.

The emergence of digital banking provides agile access to funds, reducing dependence on high-interest credit options that can jeopardize your credit score. Furthermore, community-driven platforms encourage a collaborative approach to financial challenges, eliminating the stigma around seeking assistance when it matters the most. Embracing these technologies not only helps you navigate immediate financial hurdles but also fosters a mindset geared towards long-term financial stability.

To cultivate a secure financial future, it is essential to stay informed and agile, adapting to trends that enhance your financial decision-making. As we progress into an ever-evolving digital landscape, the ability to harness these emerging tools not only fortifies your credit but also equips you with the confidence to face life’s unpredictabilities. By prioritizing strategic financial planning and exploring innovative solutions, you can turn unexpected expenses from a daunting prospect into an opportunity for growth and resilience.

Related posts:

How to Invest with Your Children's Education in Mind

The impact of credit inquiries on the score and how to manage them

Differences Between Stocks and ETFs for Investment Beginners

What to consider before accepting a job with a fixed salary and bonuses

How to Manage Expenses to Avoid Debt and Protect Your Credit

Investment Tips That Help Build a Positive Credit History

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on our website, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.